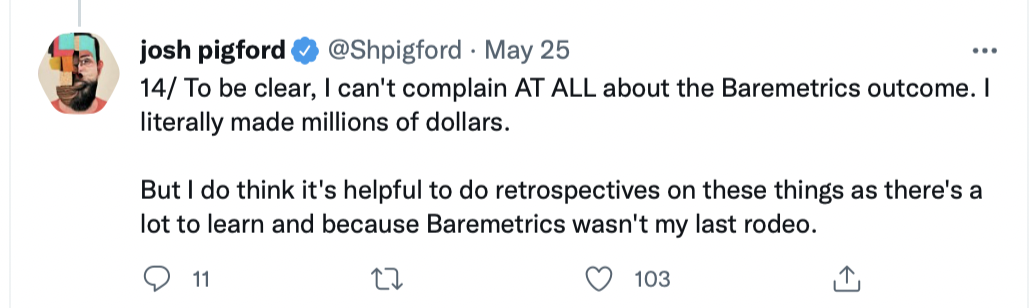

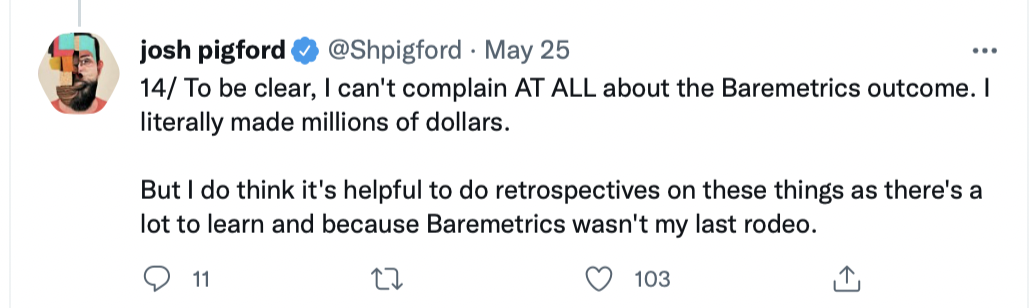

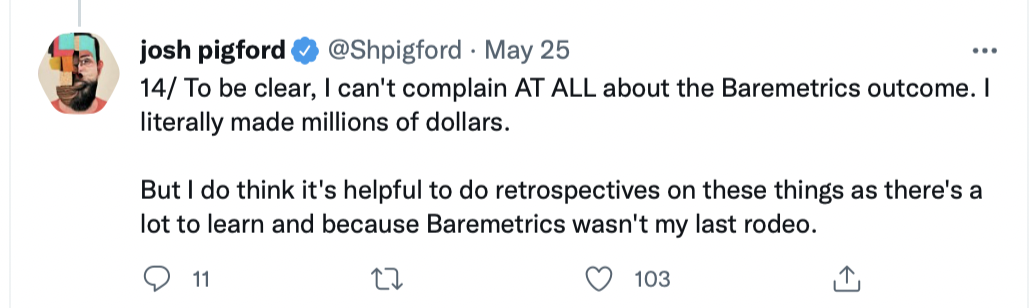

Baremetrics founder Josh Pigford took to Twitter lately to make his case for why his firm offered for $196 million lower than related firm Profitwell.

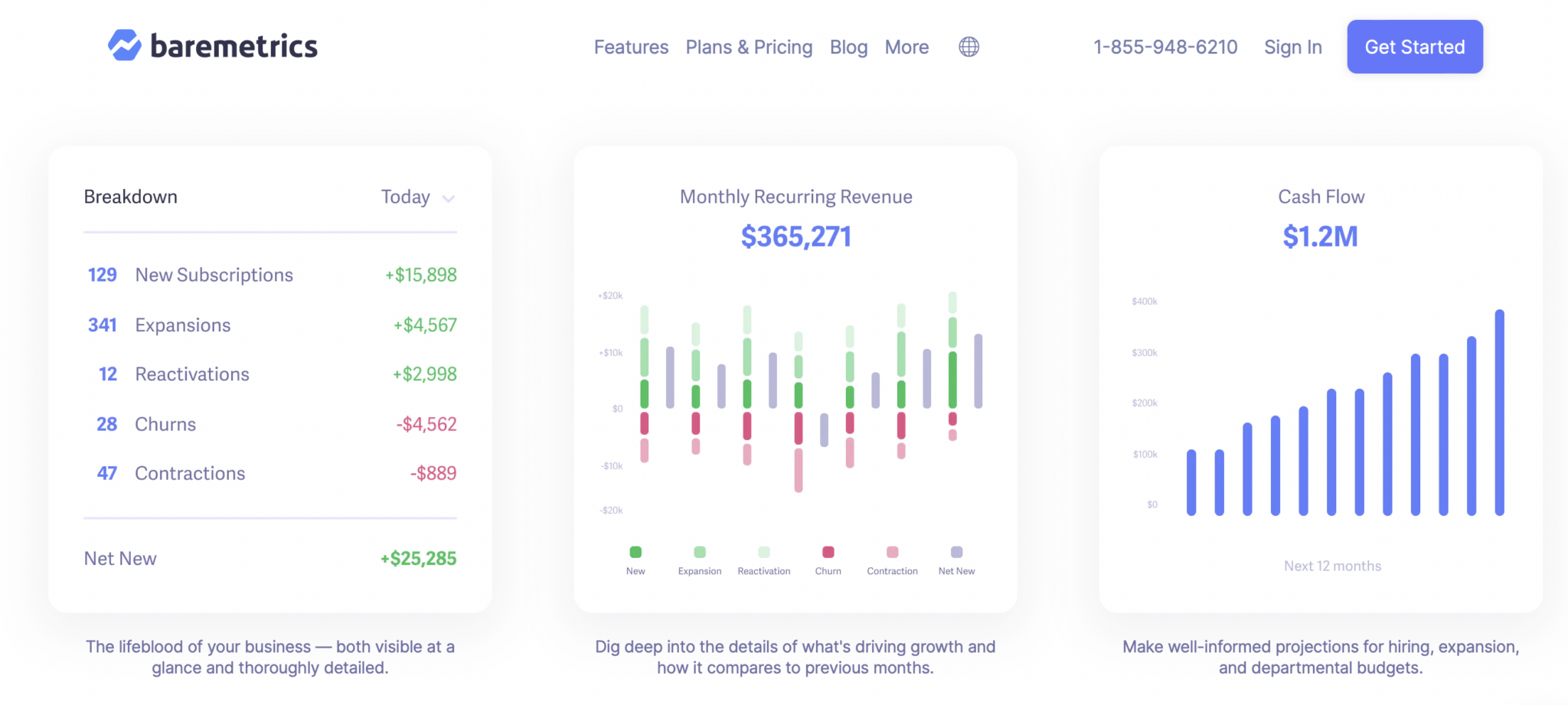

Baremetrics was an revolutionary chief within the 1-click SaaS business, however different corporations have shortly surpassed it in the case of the underside line.

What occurred?

It seems that early selections restricted Baremetrics in ways in which Profitwell wasn’t topic to. Take a better take a look at what Pigford thinks restricted the sale value of his firm.

The Aspect Hustle Mentality

Pigford believes that the last word motive why Baremetrics offered for considerably lower than high competitor Profitwell has to do with the early days of the corporate.

He began Baremetrics as a facet hustle which he claims impacted main selections made throughout the enterprise. As a facet hustle, he was pleased if Baremetrics made any cash and didn’t begin to take it critically till he was a few years into the enterprise.

Pigford was the only worker for the primary six months. And due to this, the choices he made in his spare time had an affect on the corporate’s long-term success.

One such choice was his partnership with Stripe. This might take a while to undo when he needed to accomplice with different corporations as nicely.

The Baremetrics exclusivity settlement with Stripe made it tough to grow to be system agnostic for the primary three years. After the very fact, he realized that the partnership didn’t profit the corporate as a lot as Pigford initially hoped it could.

In truth, Stripe began to implement its personal subscription metrics companies that made Baremetrics much less interesting for its customers.

Ultimately, the partnership with Stripe ended up extraordinarily one-sided and restricted the general progress potential of the Baremetrics model.

Profitwell’s Benefit

Profitwell positioned itself as a enterprise from the very begin, permitting it to make a lot smarter and savvier enterprise selections.

Jan-Erik Asplund, founding father of Sacra and an professional in personal markets analysis, breaks down how Profitwell was capable of command a a lot increased $200 million price ticket when it was acquired.

Probably the most notable distinction between Baremetrics and Profitwell was the price to its customers. The latter was nice for small companies who didn’t wish to pay cash to observe their metrics. Profitwell made metrics free and as a substitute charged on dunning.

One other profit for Profitwell was their capacity to accomplice with any firm they desired. This was preferable to being locked right into a prolonged contract with Stripe solely like Baremetrics was.

And this allowed them to develop at a a lot quicker charge.

The Backside Line

Profitwell stood to convey extra results in Paddle (the corporate who acquired them). In flip, Paddle represents a brand new enterprise mannequin that may hopefully take Profitwell to a brand new degree. This mutually helpful relationship might cleared the path in 1-click SaaS within the months and years forward.

Add Comment