Promoting on Amazon is an effective way to earn a couple of further {dollars} as a facet hustle or a full-time earnings. Earlier than you get began, it’s worthwhile to guarantee that you’re maintaining with the legalities required of sellers with the web retail big. So, do you want a enterprise license to promote on Amazon?

Nicely on this article, we are going to undergo your Amazon FBA enterprise necessities that can assist you lay a agency basis. We’ll cowl while you want a enterprise license and what sort of enterprise you might wish to type.

With out additional ado, right here is the whole lot it’s worthwhile to find out about getting a enterprise license to promote on Amazon.

Do You Want a Enterprise License to Promote on Amazon?

This query could be answered by taking a more in-depth take a look at the insurance policies associated to on-line marketplaces, however the brief reply is mostly no. Enterprise licenses should not required for on-line marketplaces, together with:

- Amazon

- Craigslist

- eBay

- Etsy

- Fb

- Shopify

Nevertheless, it might be a wise concept to get a enterprise license to your Amazon FBA enterprise for those who intend to promote federally-regulated merchandise.

A federal enterprise license could also be required for a few of these merchandise, significantly in the event that they relate to transportation, firearms, alcohol, agriculture, or aviation.

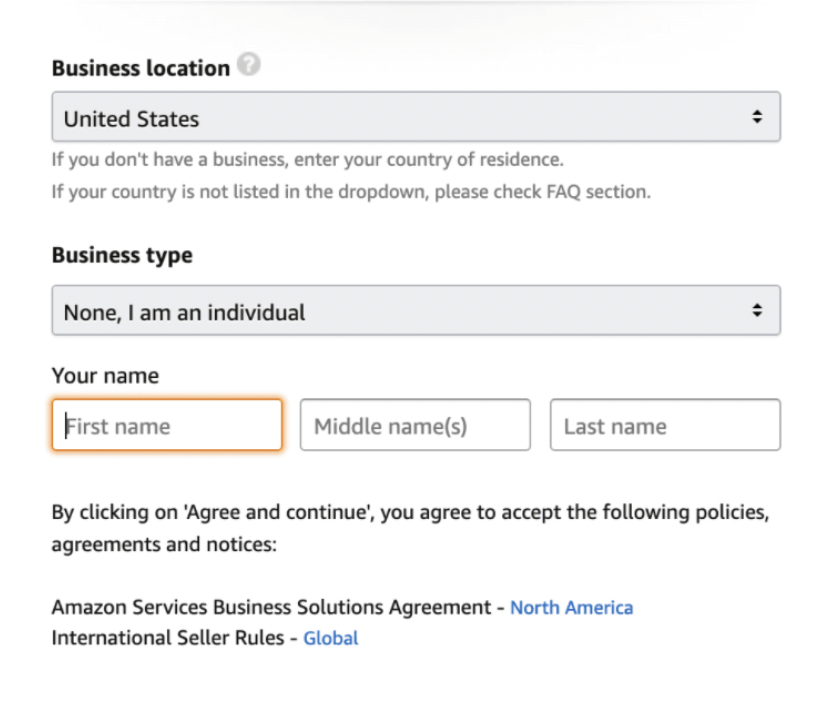

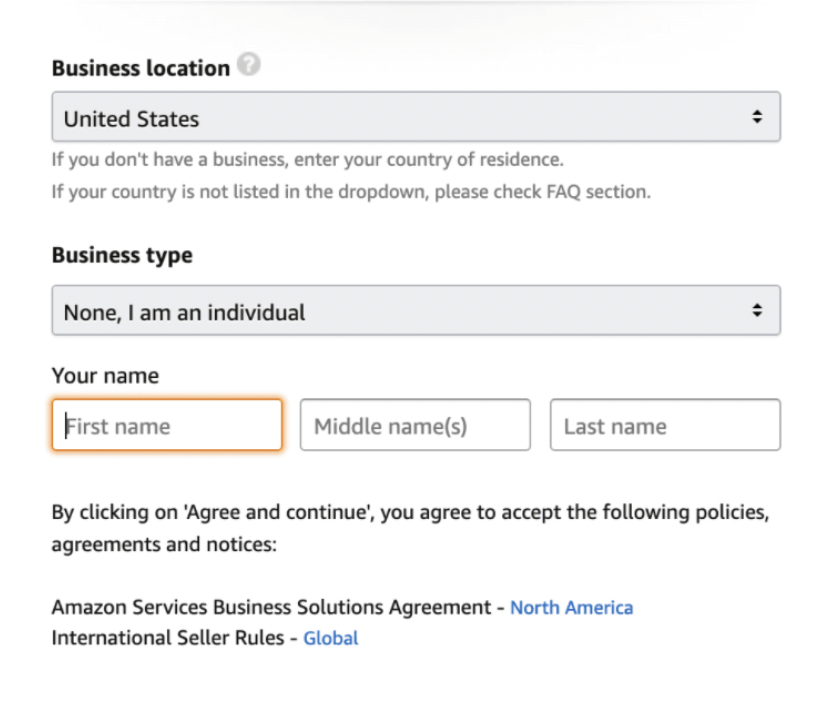

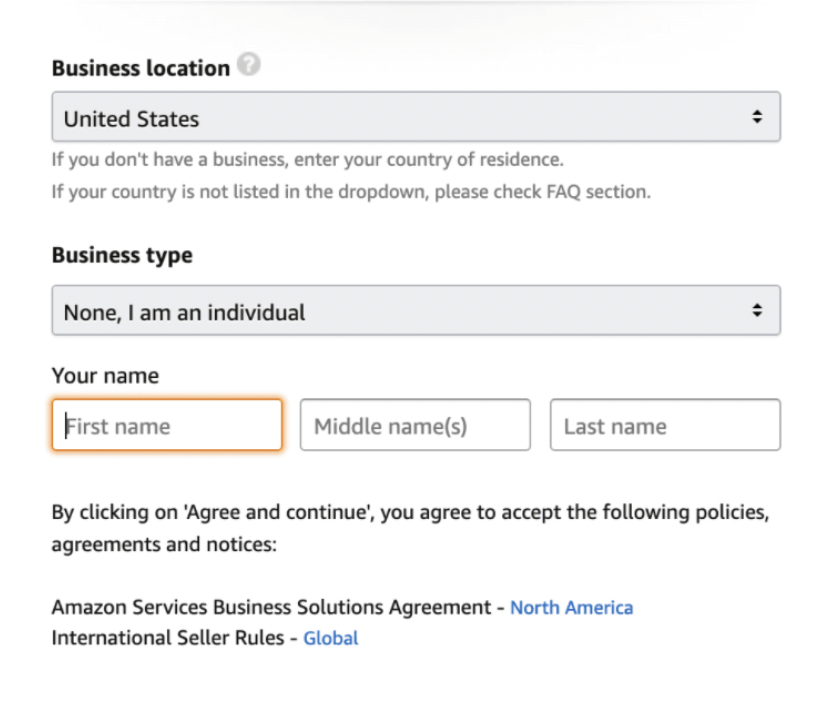

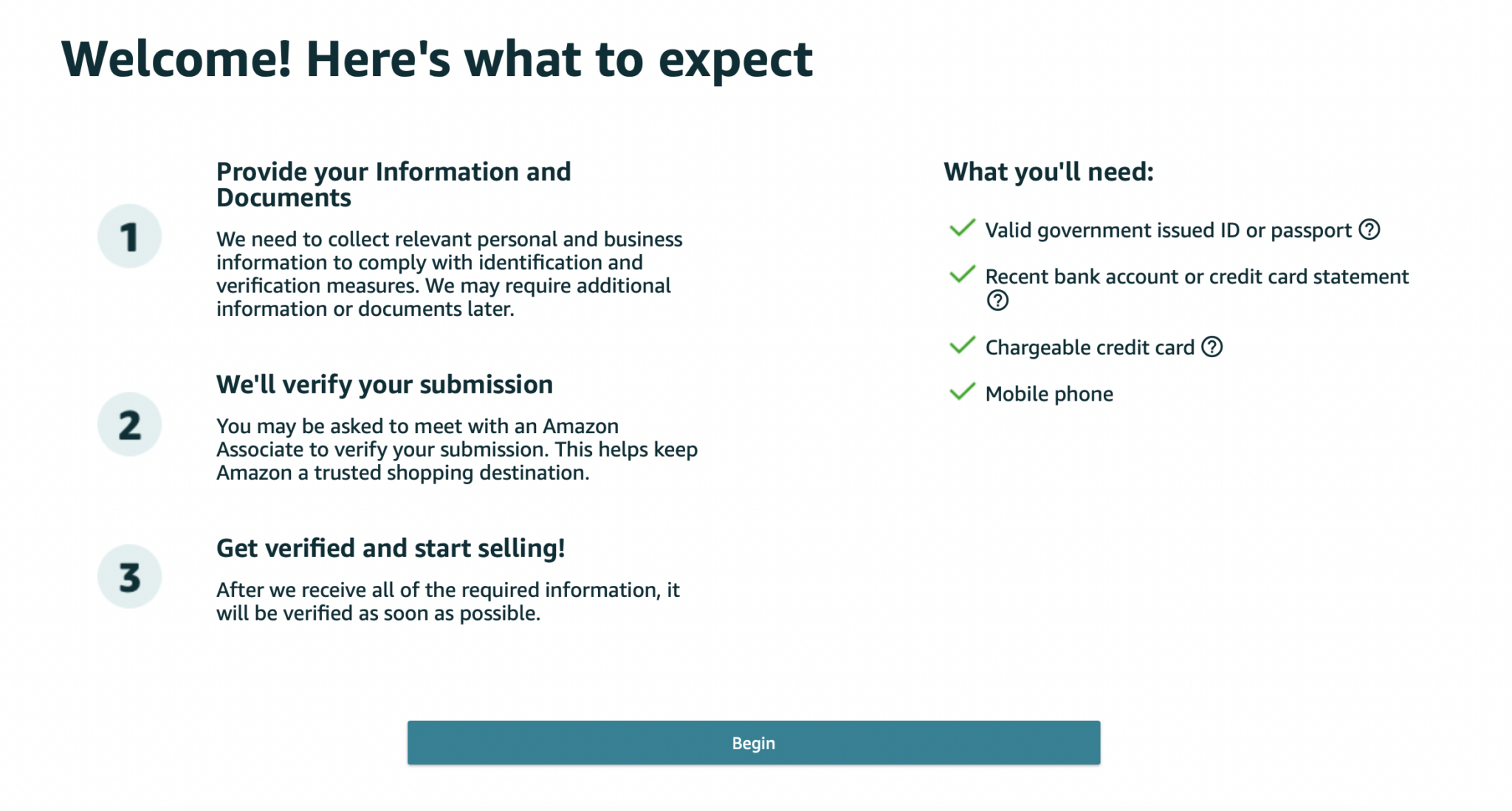

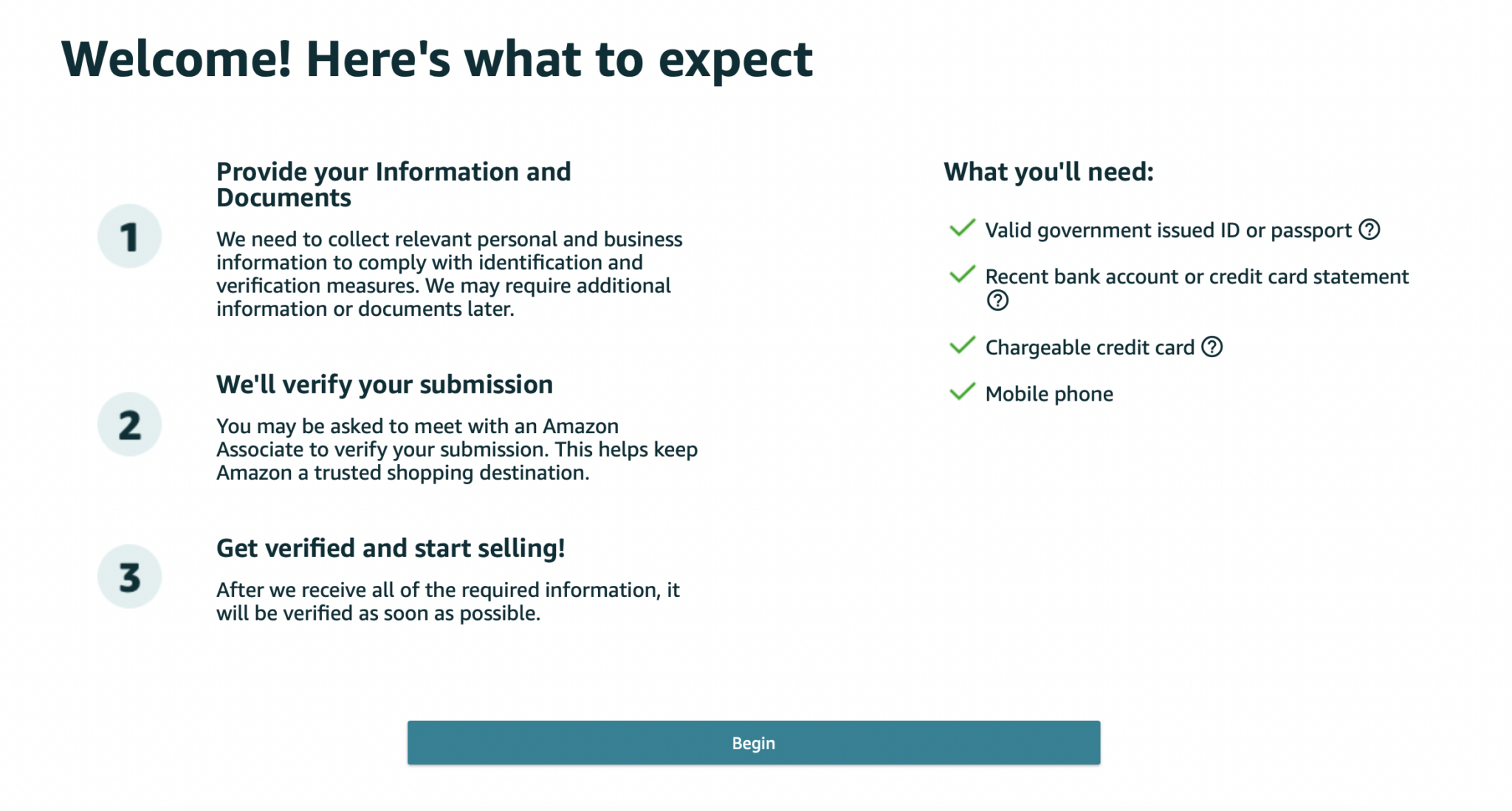

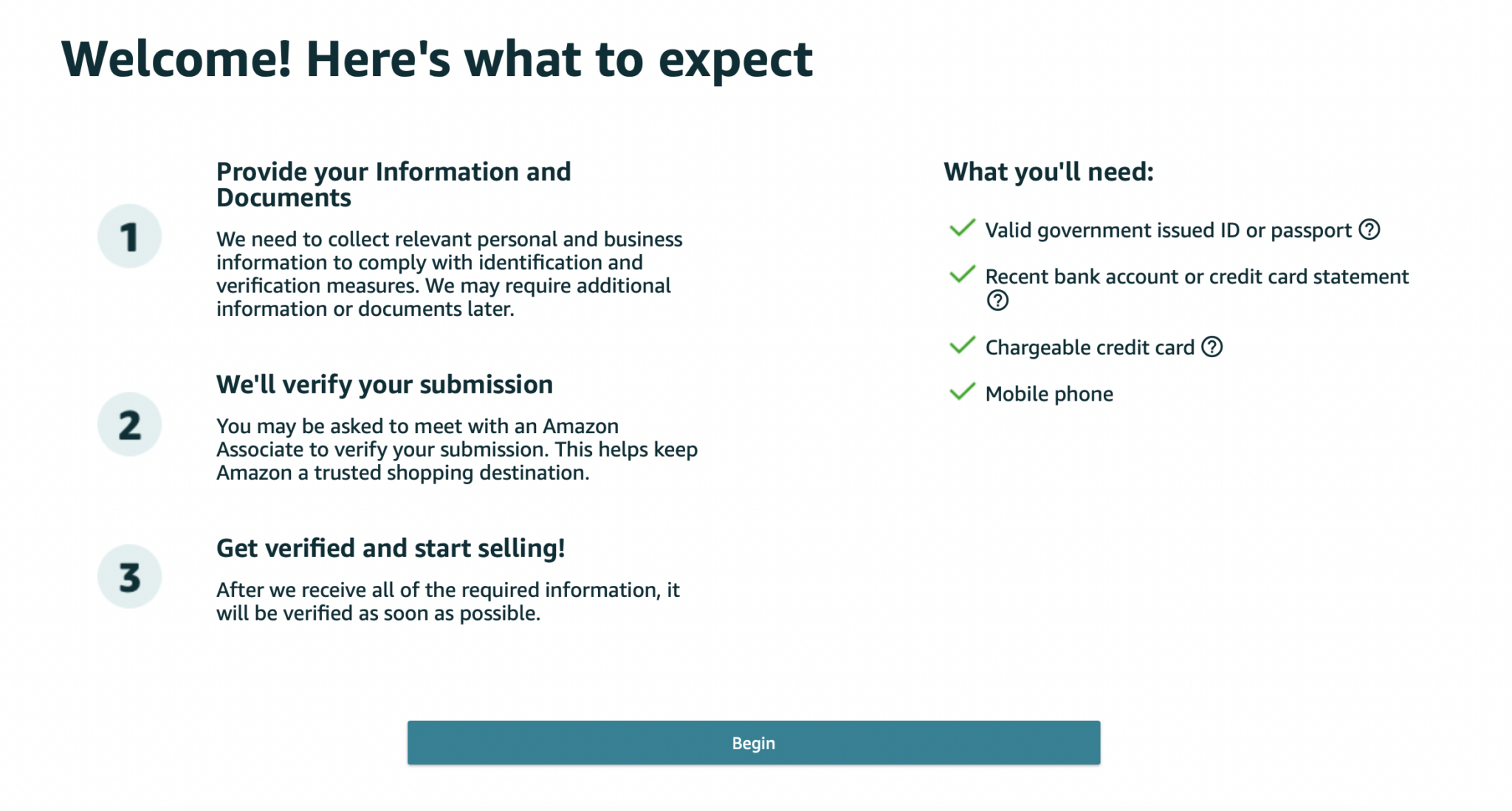

In the event you select to go the non-business license route; while you go to register with a vendor account on Amazon, it’s worthwhile to verify that you just should not have a enterprise license. In step 5, you’ll enter that you’re a person which exempts you from needing to enter something additional.

In essence, you may be working as a sole proprietor which doesn’t legally require you to register as an LLC or to have a enterprise license.

Ought to I Get a Enterprise License for Promoting Bodily Merchandise on Amazon?

Below what circumstances do you want a enterprise license to promote on Amazon?

Principally, the reply right here depends upon what sort of merchandise you may be promoting. Sure objects are federally-regulated and would require a federal enterprise license.

Nevertheless, a lot of these things should not going to be bought on the Amazon platform, together with:

I have been promoting merchandise on Amazon since 2014.

Need to know the analysis device I have been utilizing since I’ve began (and nonetheless use at present)? Get my newest ideas and tips on how to information for utilizing this device.

- Agriculture, fish, and wildlife

- Alcohol

- Aviation

- Firearms or ammunition

- Transportation and logistics (together with maritime transportation)

- Radio and tv broadcasting

On the state stage, you may additionally be required to have a enterprise license for those who interact in sure actions. Once more, most of those actions is not going to apply to your vendor account on Amazon as they pertain to auctions, building, dry cleansing, and different service-based companies.

In case you are not promoting merchandise that pertain to those classes, then you don’t want a license to run a sole proprietorship as an Amazon vendor.

Do You Want an LLC to Promote on Amazon?

Whereas you don’t want a enterprise license for many Amazon enterprise alternatives, many would-be sellers are curious what authorized entity their enterprise must be. Do you have to file for an LLC (restricted legal responsibility firm) earlier than you open the doorways in your digital store?

A restricted legal responsibility firm is nice for entrepreneurs who’re critical about their on-line gross sales enterprise. An LLC is comparatively widespread as a result of it affords you some safety within the occasion your organization will get sued. In essence, it is a authorized entity that your small business types separate out of your private belongings.

Sole Proprietorship vs LLC

Do you have to run your small business as a sole proprietorship or an LLC?

Let’s take a fast take a look at the advantages of every one.

Sole Proprietorship

A sole proprietorship is nice if you wish to get your small business off the bottom shortly. It means that you can begin your on-line enterprise with none required paperwork at both the federal or the state stage. All it’s important to do is hang around your shingle as a brand new enterprise proprietor and you might be labeled as a sole proprietor straight away.

The whole lot is tied to your individual, together with the money owed related to the enterprise. In the event you fail to make a required fee or for those who get sued to your Amazon retailer, they’re able to come after your private belongings to make issues proper.

This additionally signifies that it might be extra of a problem to acquire financing for your small business. In the event you assume that it would be best to take out a mortgage to get your Amazon FBA or Amazon dropshipping account off the bottom and begin with a number of SKUs in your storefront, then you might run into points with establishing credit score to your new enterprise.

You might also should file a “doing enterprise as” (DBA) identify for those who don’t wish to promote underneath your private identify.

LLC

As an LLC proprietor, you get pleasure from extra credibility than you’d as a sole proprietor. Your small business identify is similar as what’s in your LLC paperwork except you file for a DBA identify. Nevertheless, the actual motive to file for an LLC is to guard your private belongings.

Whenever you run a enterprise this fashion, your small business belongings and private belongings are separate. That is maybe the most effective motive to file for an LLC to your on-line enterprise.

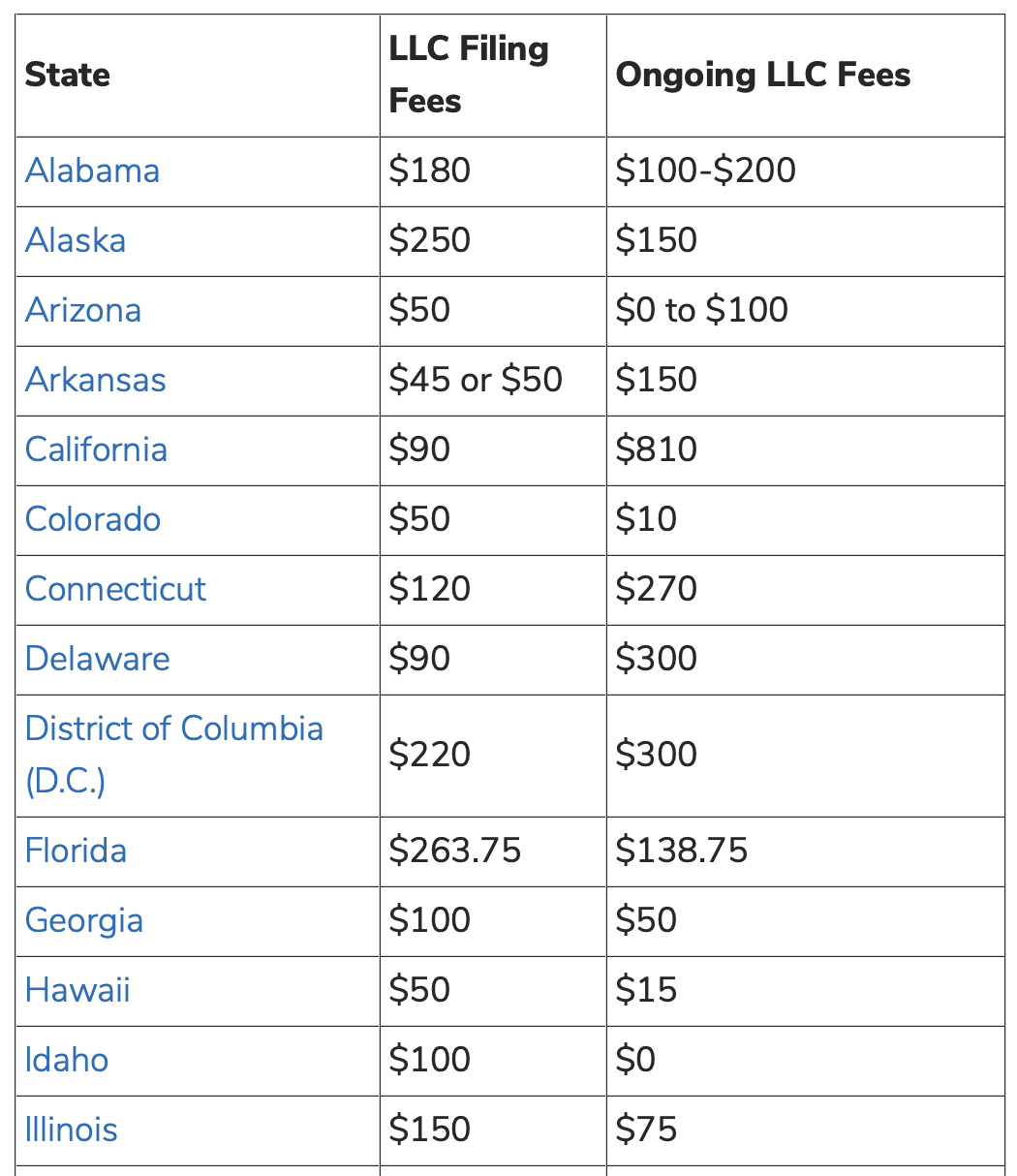

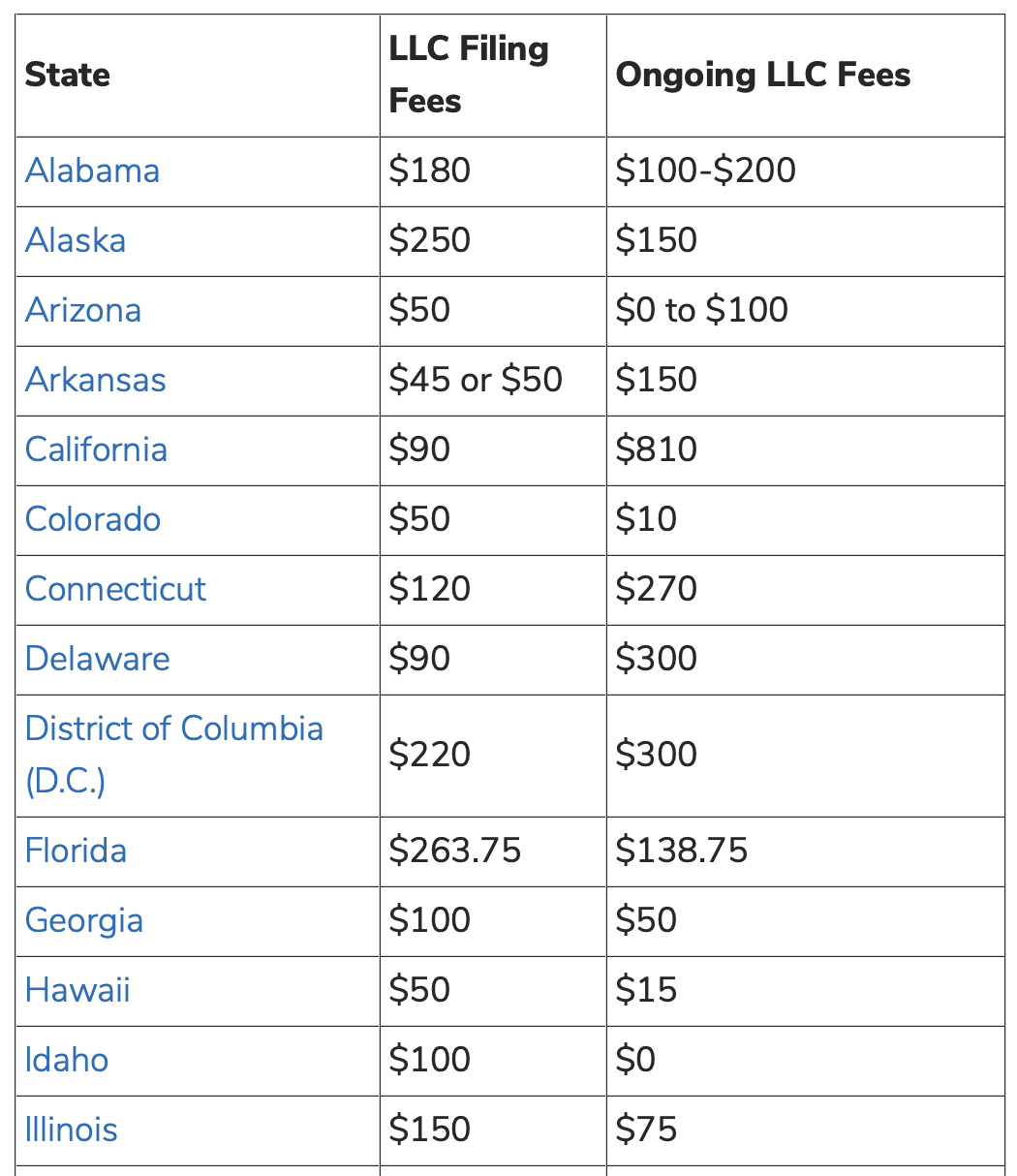

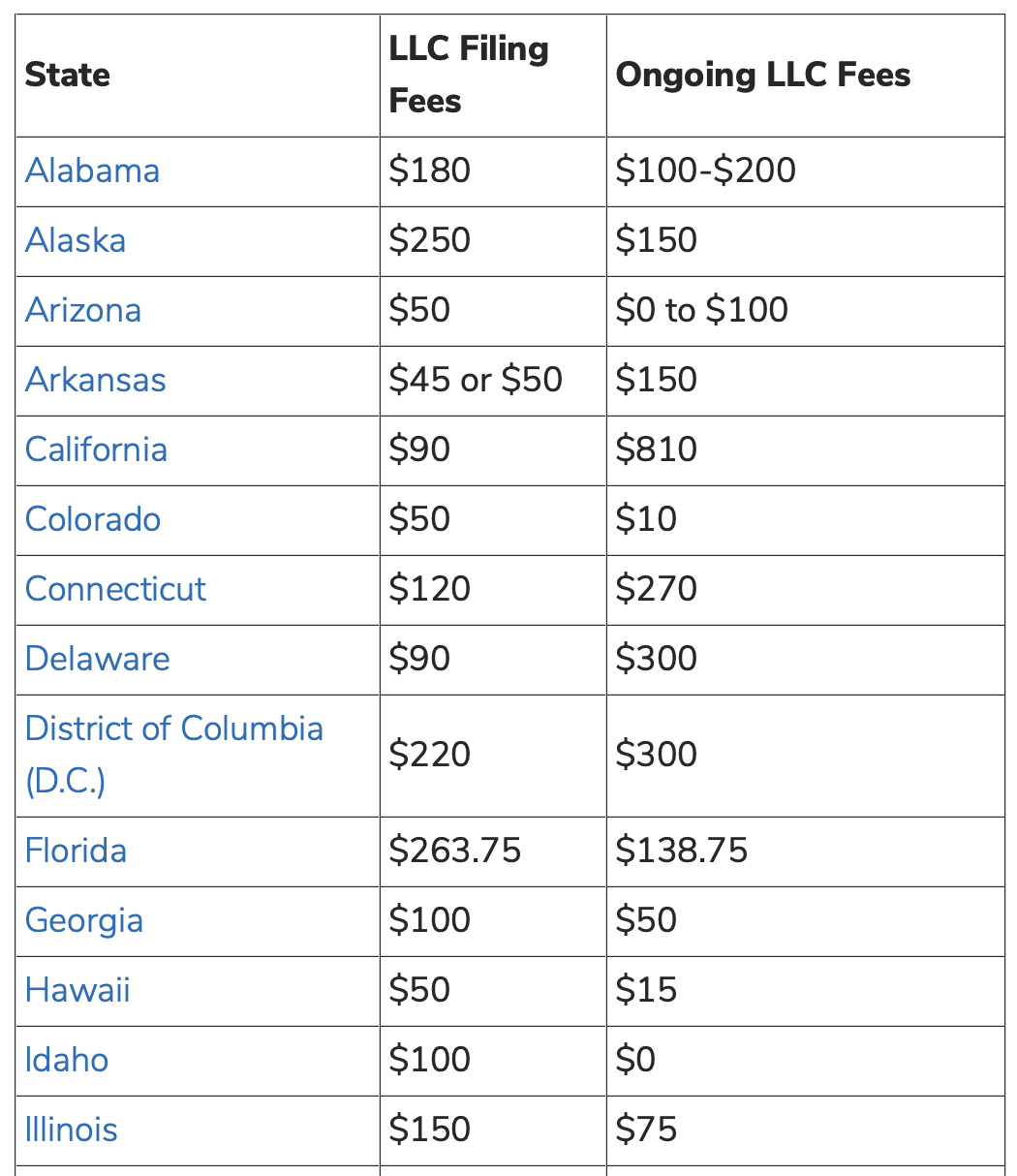

In contrast to a sole proprietorship, you will have to fill out paperwork with the state to open your doorways as an LLC. It may possibly value anyplace from $50 to $300 relying in your state. Along with your LLC, you may additionally have to get a enterprise license which is a further price starting from $50 to $100.

Over 80 % of small companies fall into the LLC class, so you might be in good firm for those who determine to pursue this enterprise construction.

When Ought to You Register Your Amazon FBA Enterprise as an LLC?

Whenever you get critical about your Amazon FBA enterprise, it might be time to file for an LLC. As talked about, this could shield you within the occasion that somebody makes an attempt to sue you. For example, over the standard of the merchandise or the claims that you just make to your merchandise.

Whereas there are not any actual tips for when you might wish to file for an LLC, it’s a sensible transfer to make no matter how a lot you might be incomes.

You by no means know what may occur sooner or later, so it may be useful to place these worries to relaxation by choosing this enterprise construction. Whereas Amazon FBA could also be a nice facet hustle for you or one thing that you just do exactly in your spare time, you by no means know when issues could take a flip south.

Give your self some peace of thoughts by submitting for an LLC as quickly as you may have the cash to take action.

Distinction Between LLC and Enterprise License

Whereas it is very important be aware that each LLCs and enterprise licenses could also be required of your new Amazon FBA enterprise, it is best to know that these should not the identical factor. Understanding the distinction between them is crucial to creating certain you get the documentation it’s worthwhile to run your small business.

Your LLC is a enterprise entity that protects your private belongings. Then again, a enterprise license is the documentation that it’s worthwhile to conduct enterprise in your space. Enterprise licenses get issued on the state, county, or native stage relying on what you propose to promote and the business that you just work.

To find out for those who want a enterprise license for what you may be promoting in your Amazon retailer, you might have to do a fast seek for your metropolis or county and “enterprise license” on Google.

Benefits of an LLC

Private Asset Safety

As we’ve seen, the most important profit from having an LLC is the safety of your private belongings. It doesn’t matter what occurs with your small business, legal professionals will view it as solely separate out of your private funds and belongings. Your home gained’t be on the road for those who somebody sues you over defective product high quality.

Extra Model Credibility

Whenever you function underneath a enterprise identify, you might be constructing a status to your model. Extra consumers are prone to make a purchase order out of your Amazon FBA enterprise if in case you have a enterprise identify as an alternative of working underneath your private identify.

Construct Credit score and Get Loans

An LLC makes it simpler so that you can construct up your credit score as a model. This will likely make it simpler to acquire financing for main purchases. Whenever you wish to put money into inventory of your merchandise to your Amazon FBA enterprise, you’ll have a neater time doing so if in case you have been diligent about constructing credit score underneath the LLC.

Disadvantages of an LLC

Value

The one actual drawback to getting an LLC to your on-line enterprise is that it may be a bit pricey. When you have minimal funds coming in out of your startup, spending a number of lots of of {dollars} in your filings can really feel like an enormous monetary stretch.

Remember to verify what your state fees for an LLC submitting. Discover out whether it is one thing you may afford proper out of the gate.

Additionally it is essential to notice that you will want to pay annual state submitting charges. At tax time, it might even be costlier to finish a tax return as an LLC over a sole proprietorship the place your whole earnings passes by means of to your private earnings.

Do You Want an EIN to Open an Amazon Vendor Account?

Intently associated to your small business license to promote on Amazon is an Employer Identification Quantity or EIN. Do you want one in every of these numbers to promote objects in your Amazon retailer? The necessities listed here are a bit advanced, however the brief reply is: perhaps.

In case you are incomes greater than $600 yearly, then you might want an EIN. Sole proprietors with staff or LLCs will want an EIN throughout the tax interview by means of Amazon Vendor Central.

Then again, you might not want an EIN in case you are a sole proprietor with no staff. On this case, you will have an ITIN or a social safety quantity to finish the tax interview portion of your Amazon Vendor Central account. Sole proprietors on this state of affairs should not eligible for an EIN.

Getting a Enterprise License for Your Amazon Vendor Account

Whilst you will not be required to get a enterprise license to your Amazon vendor account, it may be a good suggestion to not less than file for an LLC and an EIN. This provides extra safety for your small business, as you by no means know what could occur sooner or later.

When you have the capital to take a position on this new facet hustle upfront, submitting for an LLC is a worthwhile funding of your assets.

A enterprise license is simply required in case you are promoting sure merchandise, so this will not be crucial initially. Ensure to perform a little research on the native necessities in your space to see if a enterprise license is important to your on-line ecommerce enterprise.

Add Comment