Is Stash legit? Very a lot so, and this text will talk about why it’s legit, secure, and every part else it’s possible you’ll wish to find out about it.

The recognition of investing apps has elevated lately, and for good purpose. Anybody can entry the inventory market with only some faucets on their telephone.

Funding purposes are a handy and economical possibility for brand spanking new buyers to start constructing their portfolios.

We’ll unpack what precisely the Stash investing app is, the way it works, and what you possibly can earn from it. We’ll additionally cowl some nice options.

What Is Stash, and is it Legit?

Stash is legit. It is an app that provides a decrease barrier to entry for individuals who want to start investing. And the app has a checking account supported by Inexperienced Dot Financial institution. Stash is a US Securities and Trade Fee-registered monetary advisor (SEC).

Stash offers you with the assets, route, and self-assurance to make investments and enhance your wealth. The group offers the groundwork so that you can develop your funding portfolio slightly than constructing one for you.

As a result of it isn’t solely a robo-advisor that picks investments for customers, Stash is exclusive. As a substitute, Stash equips clients with the information and instruments they should make their very own investments.

Let’s face it, the considered beginning investing is troublesome and doubtless fairly intimidating. Stash takes the stress away and should even make it enjoyable!

It is best to perceive your investments even in the event you can automate them. With Stash, you possibly can:

- Make investments as little as $5.

- Develop into educated about investing.

To start out investing confidently, you want a telephone, $5, and some minutes of your time.

The founders of Stash, led by CEO Brandon Krieg, got down to democratize funding. Stash Study performs a major position of their efforts to help newbie buyers. It presents an unlimited library of educational assets and funding recommendation written at a stage comprehensible for these new to investing.

How Does Stash Work?

For those who determine to get began with a Stash account, the sign-up course of is fairly easy. Head over to Stash on-line, Google Play, or Apple retailer to obtain the Stash make investments app. Click on to start and full the profile type.

You may be requested to enter your fundamental data and reply a number of questions. Your solutions will assist Stash advise you on making funding choices. Try to reply the survey questions as honestly as potential as a result of they help in figuring out your threat tolerance.

Stash will robotically suggest a portfolio that complies along with your wants based mostly in your solutions to the questions. This system will suggest a cautious, average, or aggressive portfolio that will help you attain your targets after you have given all the mandatory data.

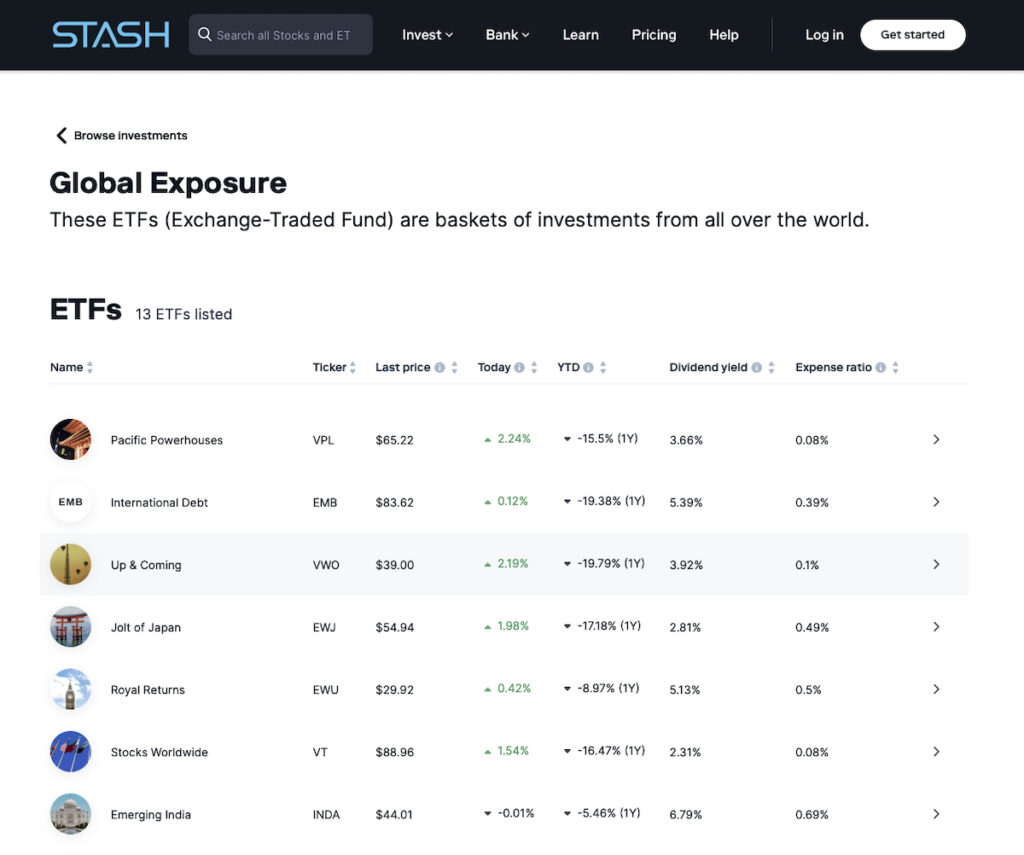

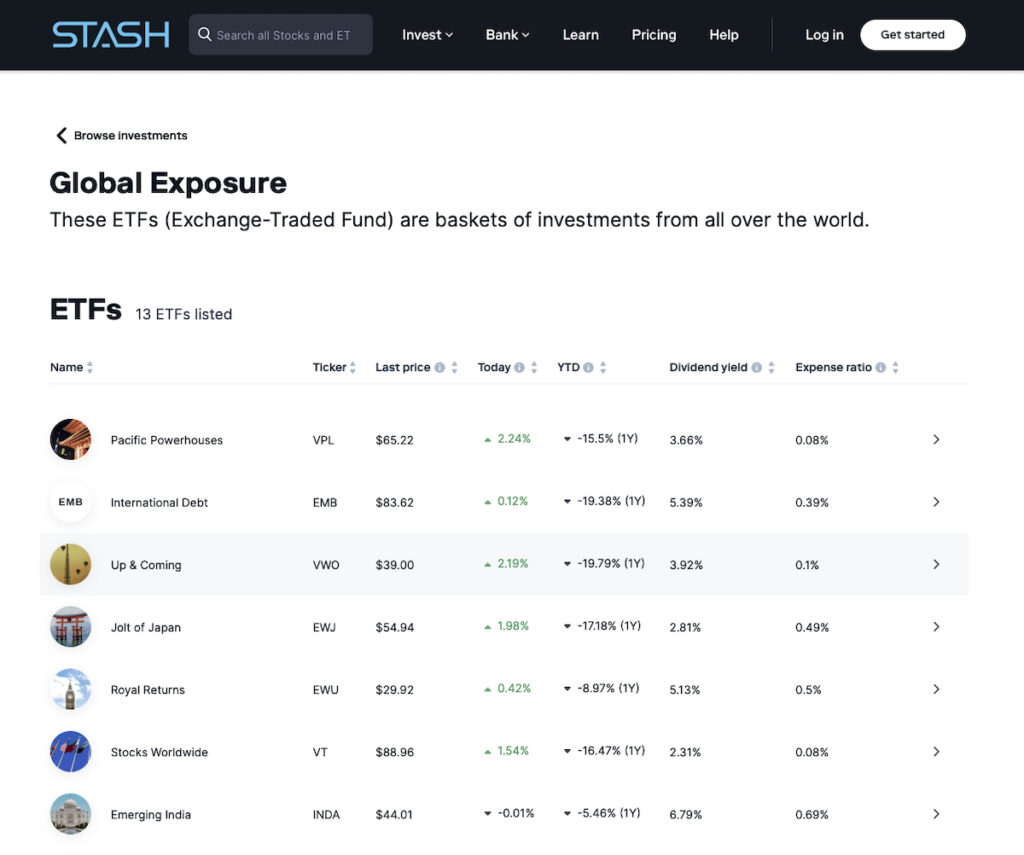

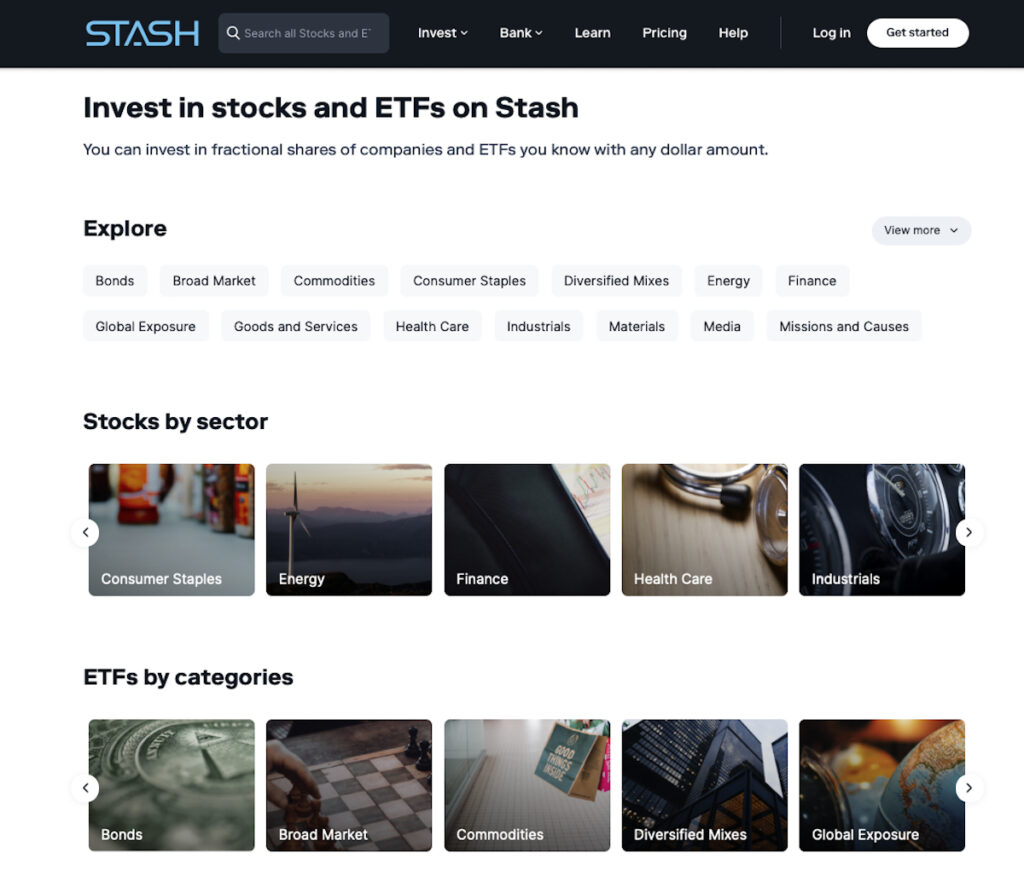

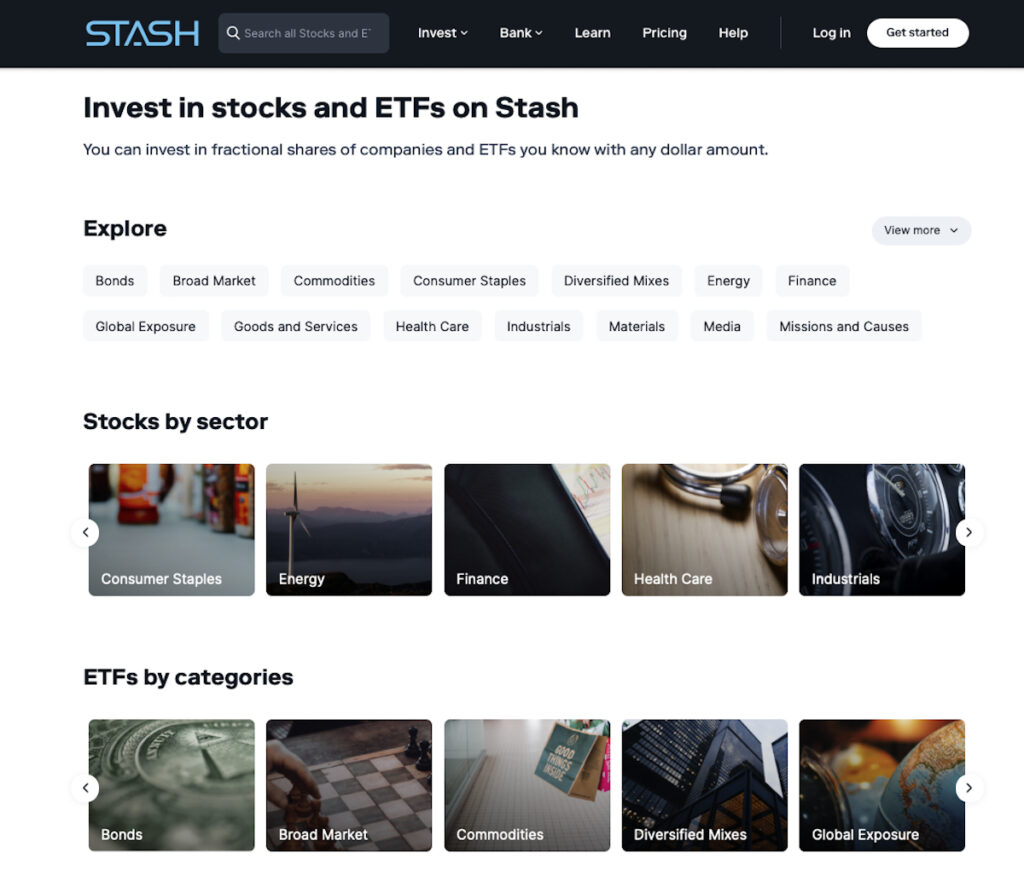

You’ll get choices from Stash’s portfolio of 1000’s of shares and exchange-traded funds (ETFs). So, it is easy to ensure your portfolio is diversified. Understanding all of the strategies you can use to extend your cash through the use of Stash merchandise is significant as a result of completely different packages have completely different advantages and prices.

You get robotically billed as soon as a month on the day you signed up in your account. Your first subscription fee happens instantly after you hyperlink your checking account or one other fee technique. Your subscription is robotically renewed except you modify or cancel it.

Stash Debit Card

You may get a Stash debit card in the event you open an account with the corporate. This account has no minimal steadiness necessities, month-to-month upkeep prices, overdraft charges, or charges for direct deposits. There are additionally no charges for ACH transfers from different banks or getting your debit card.

And there are over 19,000 ATMs the place withdrawals are freed from cost. However, in the event you use your card at any non-participating ATM or withdraw cash from a teller, you may be charged $2.50.

Since it’s possible you’ll earn Inventory Again rewards at greater than 11 million places, your Stash debit card might help along with your Stash monetary success. You’re eligible for at the least 0.125% Inventory-Again once you spend cash at collaborating retailers like gasoline, groceries, eating, or another buy. At choose retailers, you might also be eligible for Inventory-Again advantages that supply as a lot as 5%.

You obtain shares of the corporations you store at as compensation for utilizing your Inventory Again card. Corresponding to as an illustration, in the event you purchase from well-known retailers listed on the Stash platform, like Walmart, Starbucks, and Amazon. You may additionally get your Inventory-Again deposited in a diversified funding fund for purchases made at non-Stash retailers like neighborhood retailers.

To get Inventory-Again utilizing your debit card, it’s worthwhile to be enrolled in a Stash membership plan.

Two distinct Stash subscription plans can be found. Including the Stash debit card will make it easier to increase your funding account balances quick and simply in the event you intend to put money into a Stash plan.

Stash App Options

The Stash app presents a number of glorious options.

Portfolio Builder

The Stash Make investments Portfolio Builder device follows what has develop into a reasonably normal format amongst different digital automated funding companies, aka robo-advisors. It makes use of a digital threat tolerance questionnaire that takes shoppers by the method of figuring out their threat. Based mostly on this, shoppers are positioned into one in every of three threat ranges: conservative, average, or aggressive.

As soon as that’s full, the shopper’s cash is positioned right into a “group of worldwide diversified funds that meet your funding standards.”

Purchasers can open an account with as little as $5 although the agency recommends $20. The startup presents a number of subscription ranges from $1 to $9 per 30 days and a number of account varieties, together with fundamental banking accounts.

Funding Administration Instrument

Stash offers an easy investing device that lets you create a portfolio of particular person shares, bonds, and Trade Traded Funds (ETFs) with an funding of solely $1. There are two sorts of Stash investing accounts obtainable:

- Development: This intermediate account prices $3 per 30 days and has each a private and a retirement funding account. You could select between a typical and a Roth IRA (Particular person Retirement Account). Stash can help you in deciding on the optimum account sort in your wants. Moreover, you possibly can study funds and earn Inventory-Again from the debit account.

- Stash+: With this account, you possibly can open a custodial funding account for one or two kids and a private account in addition to a Stash Retire funding account. It prices $9 per 30 days and contains month-to-month market perception experiences along with monetary schooling. With this plan, you can even earn Inventory-Again and obtain a steel debit card slightly than a daily plastic one.

Each Development and Stash+ schemes allow you to select the way to finance your funding accounts and let you purchase fractional shares of inventory.

- Investing on a predetermined schedule: You possibly can arrange periodic transfers out of your checking account to economize robotically.

- Spherical-ups: If you use your debit card to make a transaction, the quantity is rounded as much as the closest greenback, and any “spare change” is invested for you.

Vast Number of Account Varieties

Stash presents a wide range of account varieties, every with particular traits to fulfill the assorted calls for of its buyers – together with:

- Customers of Stash Banking accounts can handle their cash on-line and obtain early paychecks and a Stash Inventory-Again® Card that provides rewards.

- With the assistance of a Stash advisor, customers of private funding accounts can select acceptable property.

- Stash Retire – you possibly can open a daily IRA account to deduct contributions out of your taxable earned revenue or a Roth IRA account to take a position your pre-tax revenue.

- A Stash custodial account will permit a father or mother to take a position on their children’ behalf; when the youngsters attain maturity, they’ll take over the funds.

Who’s Stash Greatest For?

Stash is great for brand spanking new buyers who solely have a bit of cash to take a position. It serves as a basis for making a strong portfolio. As a Stash newbie, you’ll be walked by all it’s worthwhile to know if you’re new to investing. Beginning small and rising your investments slowly will be fairly a reduction.

Stash make investments positions itself as being for novices. However an investor on a mission may additionally discover Stash interesting. It categorizes its shares and ETFs by topic. That is in an effort to put money into companies that align along with your private values and funding goals. ETF classes embrace, amongst others, bonds, services and products, ladies who lead, and carbon discount.

Who Shouldn’t Use Stash?

If you’re a seasoned investor, Stash may not be the appropriate alternative for you. The software program guides customers by the method of making a portfolio, which is great except you already know the way to do it your self.

And, if in case you have more cash to take a position than a number of hundred {dollars}, you could find cheaper funds at different brokerage homes.

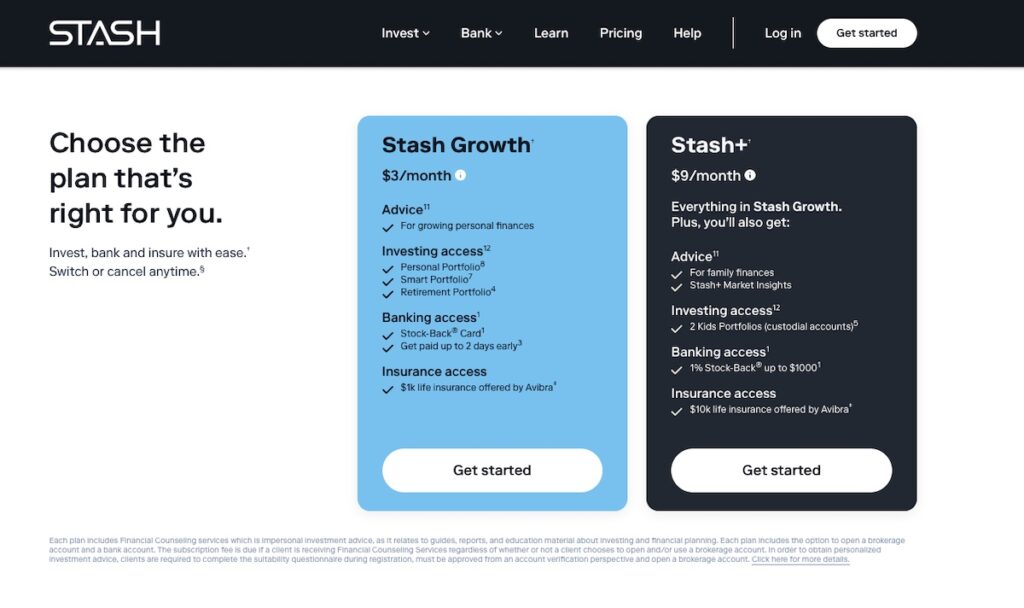

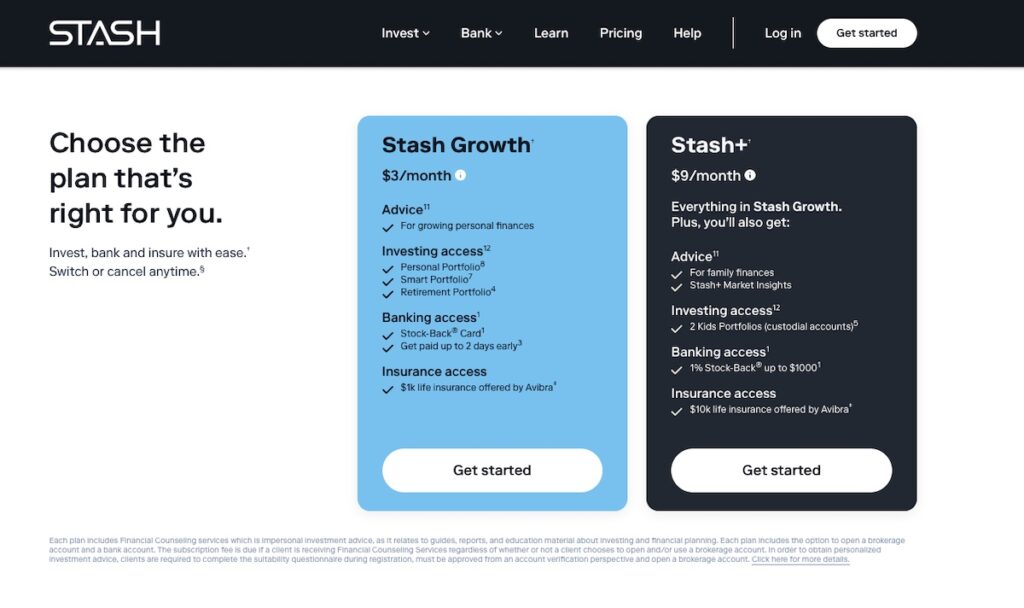

Stash Pricing

Stash Development prices $3/month, and also you get the next:

Recommendation for rising private funds

Investing entry to:

- Private Portfolio

- Stash Sensible Portfolio

- Retirement Portfolio

Banking entry

Insurance coverage entry

- $1k life insurance coverage provided by Avibra

Stash+ prices $9/month, and with this selection, you get the next.

Every thing in Stash Development plus:

Recommendation

- For household funds

- Stash+ Market Insights

Investing entry

- 2 Youngsters Portfolios (custodial accounts)

Banking entry

- 1% Inventory-Again® as much as $1000

Insurance coverage entry

- $10k life insurance coverage provided by Avibra

As with all dealer, you will want to pay an ETF expense ratio for any ETFs in your account. This usually ranges from 0.06% to 0.75%, along with the month-to-month payment.

Stash’s membership ranges are a bit uncommon. To make use of its service, you will need to be a part of a plan with a month-to-month subscription value, despite the fact that it would not cost charges on trades. The modest charges may influence your backside line, particularly if there isn’t a assurance that you’ll make a revenue. For entry to its web site, Stash costs a month-to-month subscription payment slightly than nickel-and-diming you for every deal.

How A lot Can You Earn With Stash?

The quantity you make utilizing Stash will rely upon you. You possibly can earn more cash in the event you make investments extra, and your investments carry out effectively. Remind your self that Stash investing entails threat. There are not any assurances, and though your property might enhance in worth over time, in addition they might lower in worth.

Stash claims the next: Their shoppers save a mean of $1,432 yearly utilizing their instruments. For those who did the identical – you can find yourself with greater than $135,000 in financial savings in the event you invested that cash yearly for 30 years in a tax-deferred account. And in case your investments generated a 7% annual return. Nonetheless, in the event you made an similar funding and used a robo-advisor or on-line brokerage account, you can additionally find yourself with financial savings of a comparable quantity.

If you’re severe about rising your wealth, I can suggest you hearken to the finest private finance podcasts. And examine the way to make your cash give you the results you want – you’re going to get 9 suggestions for monetary success.

Stash Payout Phrases

You possibly can usually transfer or withdraw cash from Stash everytime you like. Nonetheless, there are specific restrictions.

When you’ve got investments, you will need to first promote them and maintain the proceeds till the SEC-mandated holding interval expires.

Transfers or withdrawals usually take as much as 5 enterprise days to look in your exterior account. Enterprise days are Monday by Friday, aside from US financial institution holidays. It might take a bit of longer in the event you begin the switch on a weekend or vacation.

Stash Professionals & Cons

PROS:

- Low minimums for portfolios. With only a $5 preliminary deposit, it’s possible you’ll begin an funding account and use their robo-advisor earlier than you be taught to make your individual decisions.

- Sensible choice of investments. You possibly can make investments with Stash in a wide range of cryptocurrencies in addition to 1000’s of various equities and ETFs. In addition they supply custodial and Stash retirement accounts.

- Banking apps for smartphones. Stash presents a decent on-line banking possibility along with its monetary choices. There are no overdraft or month-to-month charges. You additionally obtain a debit card. Plus, free entry to greater than 55,000 ATMs.

- Further account benefits. Stash offers you with free life insurance coverage, however the quantities are very low. You too can earn inventory rewards with Stash’s debit card.

CONS:

- No computerized tax planning. Tax-loss harvesting isn’t a characteristic of the Robo-advisor. This technique tries to provide revenue tax benefits by promoting investments at a loss.

- Comparatively excessive charges, significantly for small holdings. For a small portfolio, Stash’s month-to-month value will be fairly hefty. For those who deposit $3 month-to-month for Stash Development and have $1,000 in your account, you’ll pay $36 per 12 months – a whopping 3.6% annual cost. The Stash payment decreases considerably as your portfolio grows.

- No human advisors. At Stash, there isn’t a actual monetary professional obtainable to help you. Skilled recommendation is barely obtainable if you wish to create your individual portfolio.

- Financial institution accounts cannot earn curiosity. For those who maintain cash within the Stash checking account, it would not earn an APY (Annual Share Yield).

Stash Options

For those who’re searching for some glorious options to the Stash Funding app – listed below are three we’ve recognized for you.

Acorns

Acorns is a cell app created particularly for the brand new investor who desires to dabble within the inventory market. It offers entry to a checking account, tax-advantaged IRAs for retirement, and its robo-advisor platform. With its main micro-investment perform, starting buyers can begin modestly by investing their spare change from common purchases.

Fundrise

Fundrise is a platform with a give attention to actual property investing and makes a speciality of managing personal actual property funding trusts (REITs). You possibly can put money into these REITs by signing as much as develop into a member of Fundrise.

Robinhood

Robinhood is a free buying and selling app for buyers who wish to actively commerce shares, choices, exchange-traded funds, and cryptocurrencies.

The Backside Line: Is Stash Legit?

Lastly, is Stash Make investments Legit? Sure, it’s. It’s a superb alternative for the newbie investor because it eliminates the 2 largest obstacles in standard investing:

- Costs are extreme.

- Info is way too sophisticated.

For individuals who lack the assets or know-how to take a position, Stash has proven itself to be a sensible funding possibility.

With Stash, investing is easy, and you can begin securing your monetary future in as little as 5 minutes. Stash additionally takes an progressive method to funding schooling that may proceed to be useful to you even in the event you go away the agency. The recommendation provided may help you in avoiding investing errors that would lose you cash. And the Stash Make investments no-fee retirement accounts for people beneath 25 are glorious incentives for brand spanking new, younger buyers.

We will confidently suggest Stash to new buyers who don’t have a lot money to start out with. Stash is a superb solution to begin constructing your wealth.

Earlier than you go, these articles may additionally curiosity you:

We want you all one of the best with rising your wealth!

naturally like your web site however you need to take a look at the spelling on several of your posts. A number of them are rife with spelling problems and I find it very bothersome to tell the truth on the other hand I will surely come again again.