An worker handles one kilogram gold bullions on the YLG Bullion Worldwide Co. headquarters in Bangkok, Thailand, on Friday, Dec. 22, 2023.

Chalinee Thirasupa | Bloomberg | Getty Photographs

Gold costs continued to hover close to document highs days after Center East tensions flared, boosting the safe-haven enchantment of bullion.

Gold costs notched one other document shut Monday, with the most-active June contract for gold futures buying and selling 0.37% larger to settle at $2,383 per ounce, and a few say there’s extra room to run.

“The latest gold rally has been aided by geopolitical warmth and is coinciding with document fairness index ranges,” Citi wrote in a observe dated April 15.

Demand for the safe-haven asset grew amid escalating tensions within the Center East after Iran fired over 300 drones and missiles immediately at Israel — most of which have been intercepted, due to Israel’s Iron Dome air protection system.

Market watchers are intently monitoring a potential retaliation by the Jewish state, which has vowed to “precise a worth” from Iran.

A major retaliation may result in a wider battle, which might consequently set off renewed shopping for of gold, in addition to a rally in oil costs and strengthening of the U.S. greenback, stated Bartosz Sawicki, market analyst at monetary companies agency Conotoxia fintech.

We mission $3,000/oz gold over the following 6-18m.

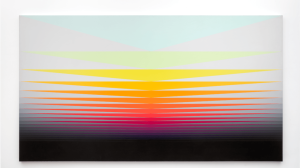

Gold costs for the reason that begin of the yr

Despite that, analysts stay bullish on the yellow metallic’s outlook, boosted by continued bodily demand in addition to its enchantment as a geopolitical hedge.

“We mission $3,000/oz gold over the following 6-18m,” stated Citi’s analysts led by Aakash Doshi, Citi’s North America head of commodities analysis. The monetary gold “worth flooring” has additionally moved larger from round $1,000 to $2,000 per ounce, Citi stated.

On Friday, Goldman Sachs referred to the gold market as an “unshakeable bull market” and revised upward its worth goal for the yellow metallic from $2,300 per ounce to $2,700 by the tip of the yr.

— CNBC’s Gina Francolla contributed to this report.

Add Comment